How to Invest in Artificial Intelligence -- 3 Companies to Watch

Artificial Intelligence has long been a staple of science fiction, from lethal robots to destructive, self-aware software. These outlandish scenarios continue to be compelling, and that's partly because AI has been creeping into everyday life at a rate never seen before. From the sudden reality of driverless cars to Siri's clever retorts on the iPhone, AI is a bigger part of our lives than ever.

How big, exactly? It's hard to say, but Goldman Sachs predicts AI could be as disruptive as the Internet. AI won't cause large-scale closures of businesses like the Internet has, but Goldman Sachs says adopting AI will be necessary for companies to stay in business. AI would also provide opportunities for fresh businesses to enter the market.

Companies of all sizes are making the foray into AI. Decades ago, this notion would have seemed purely science fiction. Now, it's a tangible opportunity that could pay off to investors.

A Brief History

The notion of practical AI has been around for decades: Back in 1950, the pioneering computer expert Alan Turing proposed the notion of a test that could be used to determine if an AI is indistinguishable from a human in communication.

This Turing Test inspired countless authors and screenwriters imagining what a world of human-like computers would be like.

In reality, developers have aimed at smaller tasks to varying degrees of success. One of the first mainstream successes was IBM's Deep Blue computer, which took on the reigning chess world champion in 1996. Humanity won the first matchup, but lost to Deep Blue later that year.

AI Today

1996 feels like a lifetime ago, and AI is now known for more practical purposes than playing chess. In the medical field, AI saves lives by assisting doctors and reducing errors. In manufacturing, automated factories are demonized by laid off workers, but valued greatly for their incredibly productivity.

Not all advances in AI have to be big or important. The ridiculous-looking Roomba is a household vacuuming robot that has caught on.

Recent Developments

We appear to be on the cusp of a golden age for AI developments and many large, publicly traded companies are getting in on it. Here are some investment opportunities to look out for.

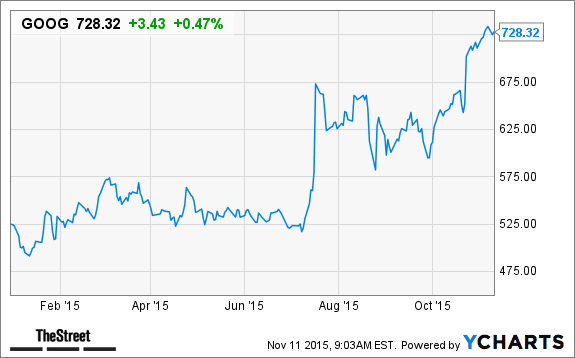

data by

Google/Alphabet (GOOGL) (GOOGL)

Google has been increasingly investing in AI, a move that goes beyond its much-hyped self-driving cars that are currently being tested. In October, Google took a stake in a Chinese AI firm started by a former employer.

The company, Mobvoi, focuses on wearable products for consumers and robotics. Less groundbreaking but even more interesting is a brand-new email program that will automatically reply to messages.

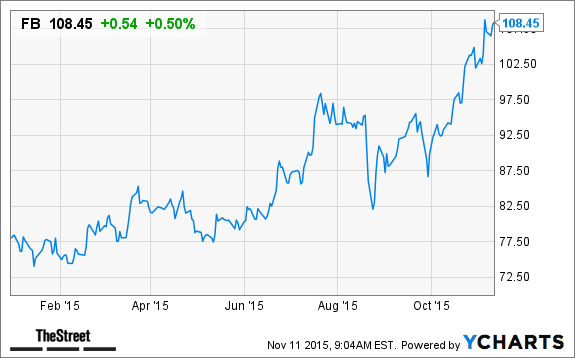

data by

Facebook (FB)

Facebook is also getting in on the AI game with its new Siri-like messenger service. Named M, this AI can answer questions about what time a movie starts, how to plan a vacation and more.

What sets M apart from Siri? Humans closely supervise the AI in order to ensure that the answers are useful. Human and machine work together for the project Facebook hopes will increase the popularity of its Messenger app.

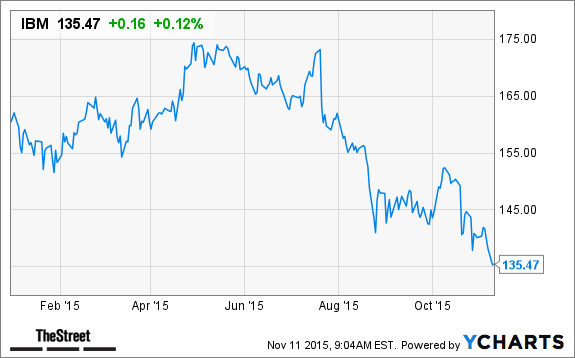

data by

IBM (IBM)

IBM is the granddaddy of well-known AI programs thanks to its chess-playing Deep Blue phenom. Its AI program Watson is far more sophisticated -- so sophisticated, in fact, that the program beat former Jeopardy champions at their own game.

Watson is far more than a TV gimmick. The program's tools are being provided to start-up companies, so Watson's fingerprints are spreading outside the confines of IBM and earning the company money in the meantime.

The Future

All signs point to big companies' continued investment in AI while smaller, nimbler start-ups make their own breakthroughs.

We may not be near the robot apocalypse predicted by science fiction, but we are in an age where AI is big business to investors.

This article is commentary by an independent contributor. At the time of publication, the author held no positions in the stocks mentioned.